Key Highlights:

- The Trump administration has allowed NVIDIA to sell its H200 AI chips to China, with a 25% fee attached, ending months of uncertainty.

- Alibaba and ByteDance are among firms seeking H200 orders, pushing NVIDIA to evaluate expanding production capacity.

- China hasn’t approved shipments yet and may require H200 purchases to be bundled with local AI chips to protect its ecosystem.

The past year has been anything but quiet for the global chip industry. While trade policy under the Trump administration has been a major talking point for months, a latest decision this week has suddenly pushed NVIDIA back into the spotlight. After prolonged uncertainty around AI chip exports, the U.S. government has finally become lenient.

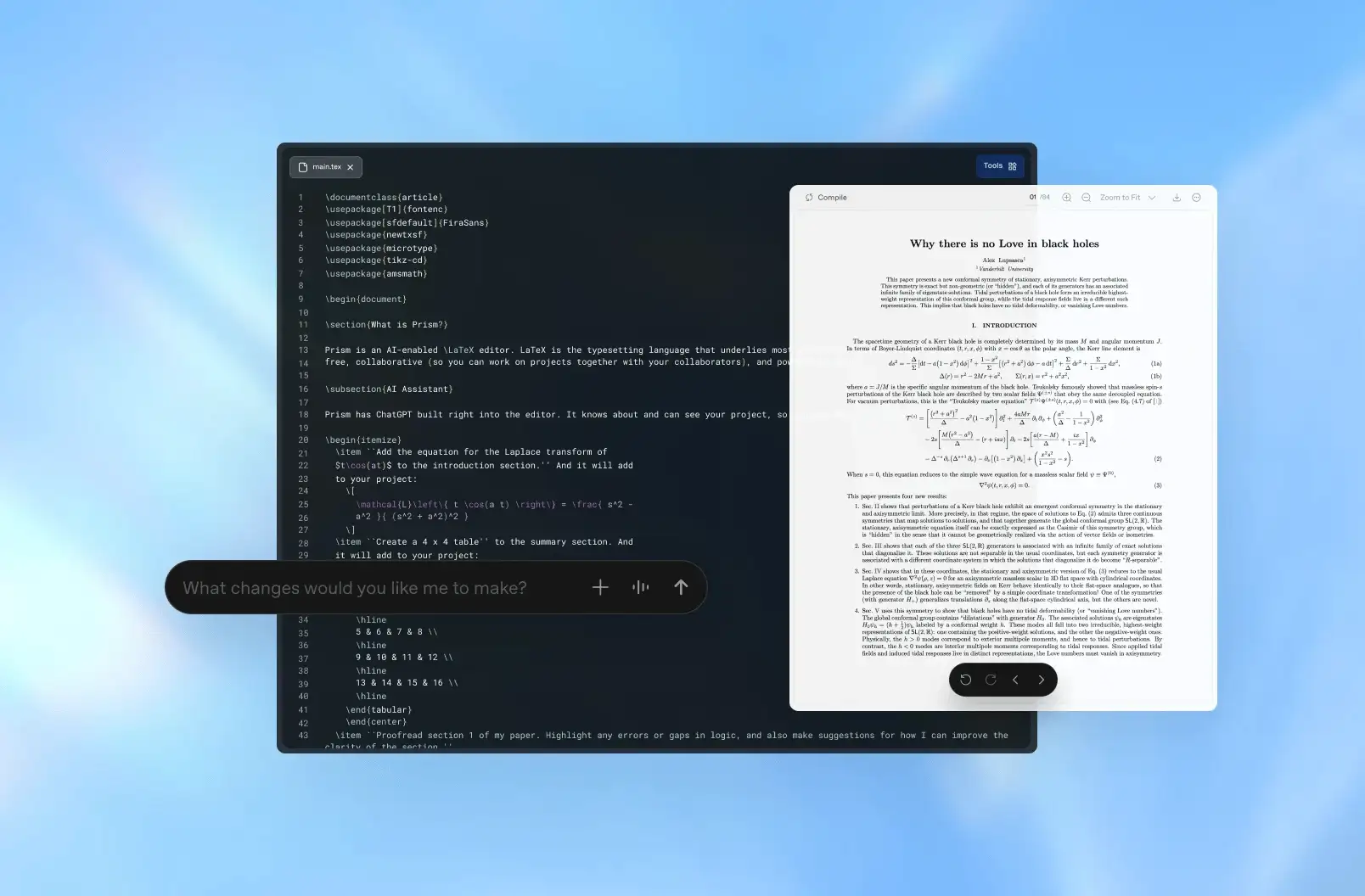

NVIDIA is reassessing H200 AI chip production capacity after getting green signal from Trump administration

According to an exclusive report by Reuters, NVIDIA has told Chinese clients that it is evaluating an expansion of H200 production capacity. after demand quickly surpassed existing supply of these AI chips. Orders from China reportedly spiked almost immediately once the U.S. gave green signal.

To catch you up, NVIDIA is now allowed to sell its H200 AI processors to China. However, U.S. wants the company to collect a 25% fee on such sales. Now, NVIDIA is now reassessing whether its current production plans are enough.

Chinese tech giants, including Alibaba and ByteDance have already reached out to NVIDIA to explore the import of H200 AI chips. In other words, it shows just how strong the demand is for high-end AI chips. For many Chinese firms, NVIDIA’s H200 is the most powerful AI processor that they can realistically access right now, and that fact alone makes it highly sought after.

For Chinese buyers, the urgency is easy to explain. The H200 is significantly more capable than NVIDIA’s H20. For the uninitiated, that’s a downgraded chip released for China. However, the performance in comparison to H200 is massive, which is why the latter is the most demanded AI chip by cloud providers and AI developers in the region.

You may also like: NVIDIA CEO Demands Companywide Adoption of AI

NVIDIA’s dilemma

Supply remains another major roadblock for NVIDIA because H200 volumes are reportedly limited for now. That’s because the company is focused on ramping up its newer Blackwell platform and laying the groundwork for its upcoming Rubin architecture.

The H200 itself is manufactured by TSMC using its 4nm process, which is already under heavy strain as multiple companies compete for advanced chipmaking capacity. For NVIDIA, scaling H200 production won’t be straightforward. The company is juggling a generational transition while competing with players like Google for scarce TSMC capacity.

You may also like: NVIDIA CEO Warns China “Will Win” AI Race With US, But Softens His Stance Later

China is worried of wide adoption of NVIDIA’s AI chip

While the U.S. has opened the door, China has yet to give formal approval. Reports suggest Chinese officials held emergency meetings to weigh whether H200 shipments should be allowed at all. Apparently, there were some discussions around each H200 purchase to be paired with a certain quota of domestically produced AI chips. This is a clear hint that China wants to move ahead protecting its local semiconductor goals.

At the same time, China continues to push its domestic AI chip ecosystem forward. That being said, the local chips are still far behind what NVIDIA has to offer. And one of the reasons why Chinese officials are worried is that the widespread adoption of NVIDIA’s H200 could slow progress at home. Analysts note that China’s AI demand already exceeds what domestic suppliers can deliver.

Whether NVIDIA ultimately boosts output may depend less on demand, which is clearly there, and more on geopolitics, manufacturing realities, and how both governments choose to move next. Only time will tell the outcome.